Sponsored by

AI-Generated Insights for Smarter Customer Conversations

Leverage AI to surface key takeaways and trends in your QBRs, customer reports, and presentations. Matik connects directly to your data sources to ensure accuracy, while AI-powered insights help your team highlight what matters most to your customers.

Just tell Matik who the content is for, and it will personalize all elements, including text, images, tables, and charts. Instantly generate data-rich files in Google Slides, Microsoft PowerPoint, Google Docs, and PDFs, so your team can spend less time assembling content and more time driving impact.

Hi, Markus here. Welcome to a new episode of the Customer-Value-Led-Growth Newsletter.

I share strategies and guides to help you become a proactive CSM, deliver more value for your customers, and turn it into revenue for your company every week.

Need additional help? Check out these resources 👇

Do you hate it when people refer to CSM as glorified support? Or when it’s called a cost center? Or when it becomes the catch-all post-sales department?

Of course, these are all rhetorical questions. The disrespect you face hits even harder when it comes from your leadership.

The most important asset in CSM should be the report you use to demonstrate value to your customers’ key stakeholders, buyers, and sponsors.

Or your customer education and training program, if we consider it as a single asset.

But the reality is that to even come that far, you need to create an environment that supports it. Or at least does not stand in your way.

In today’s post, I’ll share how to build a leadership report that unmistakably proves the value you bring to your company.

1. Churn Analysis

It’s very hard to kill. Maybe even impossible. I’m talking about the perception among the C-suite that CSM is the anti-churn squad.

That can miraculously prevent all customers from leaving, and if they don’t, it’s because they have not done a good job.

The first part of your report (suggestion, not a rule) should bust that myth.

Run exit interviews with your customers and categorize the main reasons for leaving by who’s responsible.

This is not about pointing fingers. It’s to show the reality and to start your leadership holding the team who “owns” the churn reason accountable for fixing it.

It’s unlikely that you’ll get all your customers to give you their time for an exit interview. Likewise, take an exit survey for your “scaled” segments.

But that does not matter. What matters is the distribution to understand where most churn is coming from.

However, that does not mean you are exonerated from any responsibility, and all churn is caused somewhere else.

In terms of your doings, your share among the total churn should be declining until it reaches a low point where it’s just “natural attrition”.

2. Churn Saving & Recovery

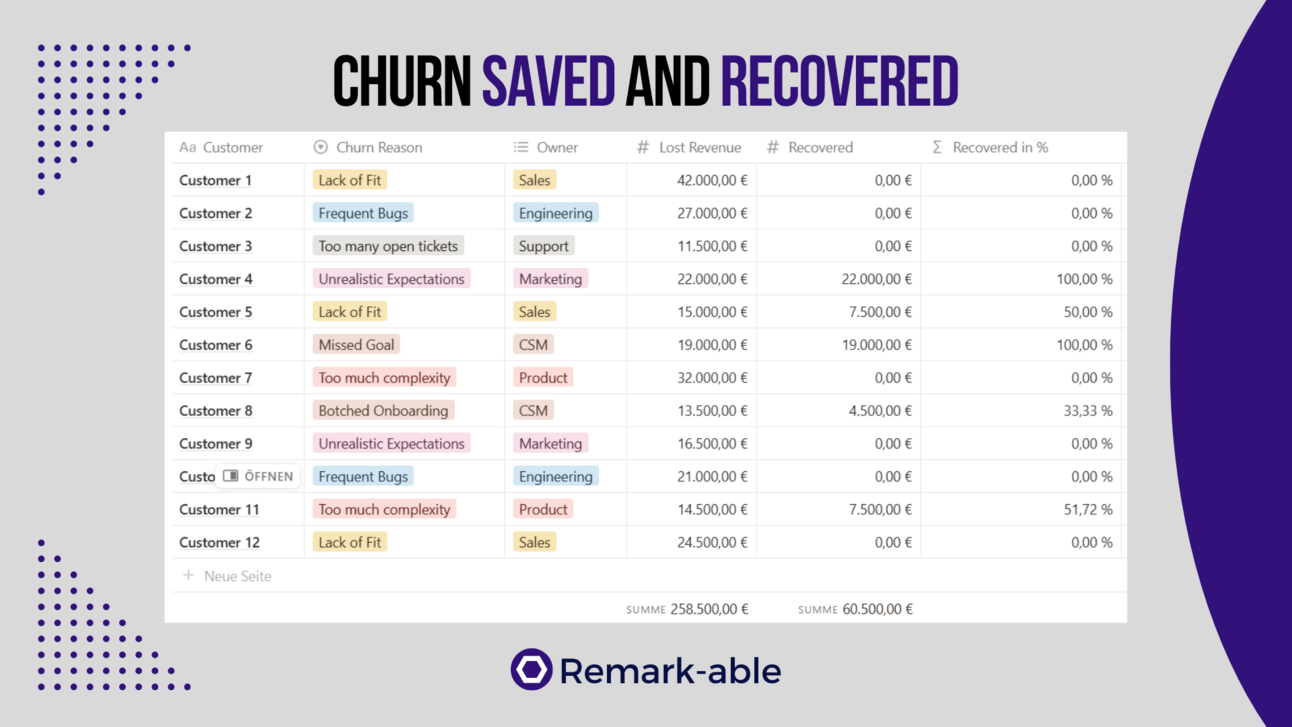

As a CSM, you can potentially fix churn that has been caused by your shortcomings. Namely, the content and services you provided - or did not provide.

Highlighting how you’ve fixed your own mistakes is, obviously, not very impressive.

It becomes a whole different story when you are turning the tide with customers who are leaving/have already left due to reasons not under your control.

Make no mistake, succeeding with it is extremely hard, but it’s worth trying nonetheless. Assuming that the respective customers are profitable for your company.

Here are some possibilities:

Recalibrating Expectations: Customers are oversold because sales reps don’t understand your product’s capabilities good enough, or on purpose. When customers find out the truth, they feel tricked into buying. However, there’s a tiny chance to turn the tide if you can sell a different outcome that is appealing enough.

Recalibrating Product Capabilities: Overselling does not only refer to outcomes but also to what the product does and what it does not. The worst-case scenario happens when features don’t even exist. The potential solution is to show customers workarounds that make the absence of these features irrelevant.

Recalibrating Product Tiers: Customers were talked into buying features that were irrelevant in general or at their current stage. It’s easy to understand that if they are using 20% of the features or less, they might conclude the product is not the right choice. The potential solution is to downgrade their tier to the features and resources they can put to use.

Make it hit hard by sharing a few examples (stories) on top. Show how your specific efforts turned the tide and prevented your company from losing more revenue and profits.

3. Customer Expansion

Customer retention is the lifeblood of any kind of SaaS company. And yet, it’s the low-hanging fruit. Beyond the early stages, where you are figuring things out, churn should be low and stable (<10% annually).

The part where it becomes juicy is when it comes to growing the value of your customer portfolio. NRR is the (new) gold standard for CSMs in 2025. Therefore, it does not matter if you have direct commercial ownership or leave the expansion sales to the AM/AE.

You need to report your impact on growth because customers only buy more after they get definite proof of value and start looking for ways to further grow it. Bluntly stated, you complete 98 of the 100 steps toward the customer expansion. 100 if you are handling the sales yourself.

I recommend splitting customer expansion into opportunities and won/closed. This way, you can show the total revenue you’ve created and conversions. Depending on your business and the customers you are working with, you may also break it down into different segments.

Add some examples again that highlight how you’ve been the driving force behind growing customer demand.

4. Customer Referrals

New customer acquisition has always been the most expensive growth lever in SaaS. In the past 3 years, it has become even worse. Customers have become more risk-averse, and trust (in salespeople) continues to erode.

Consequently, sales cycles become longer and conversion rates lower. But there’s one exception. People trust what other people say. Prospects coming through peer recommendations close at much higher rates.

Contrary to what your leadership may believe, customers don’t give these recommendations because your company has such a great advocacy program. What drives word-of-mouth is customer value and relationships.

The challenge in reporting your influence on new customer acquisitions lies within attribution. Ideally, you can distinguish between:

New ARR through word-of-mouth from self-reported attribution from customers (“How did you hear about us?”)

How much of it is directly attributable to a specific recommendation (new customer directly mentions an existing customer)

How much of it is attributable to a former customer who advocated for your product at a new employer

If you don’t have any of the data, you are not able to demonstrate the full impact of your work. Collaborate with marketing/sales to source it.

They should both have a strong interest in getting the data for their purposes. If that does not work, ask your customers directly, no matter how awkward it feels to do it after the purchase.

Here’s how I can be of further help 👇

Training Platform: Become 1% better at delivering, growing, and monetizing customer value every day.

Coaching: Upskill faster and further with weekly coaching calls in a team or leadership setup.

Courses and Guides: Get the strategies, tools, and processes to move from reactive CSM to Customer Value-Led Growth.

Sponsorships: Promote your product, service, content, or event to 9.6k+ CS professionals in my newsletter or 51k+ on LinkedIn.